Do a no-spend challenge: Try to eliminate spending for a month (or several) on a problem area in your budget, such as clothing or entertainment.You can ask a lender for a modified payment plan or refinance your debt into more manageable payments. Negotiate with creditors: If debt payments are pushing you into the red, reach out to your creditors.But going through your bank statements to see what you really spend can help you find areas you can work on. Review your spending: It’s easy to guesstimate your spending with the calculator above.Find ways to boost your income: Whether it’s working a side hustle or a part-time job or asking for a raise at your current job, finding a way to boost the income side of the equation can have the biggest impact of all.Other: This is for all other expenses that don’t quite fit in any of the categories above.Savings and investments: Money that you regularly save for an emergency fund or vacation fund, as well as long-term goals like college, retirement, and a home.

It also includes medications, glasses or contacts, and the like. Health care: This includes all the out-of-pocket costs for health insurance, dental insurance, and vision insurance, such as premiums (if they're not deducted from a paycheck), copays, coinsurance, and deductibles.This category also includes debt payments (outside of mortgages and student loans) and vacation expenses.

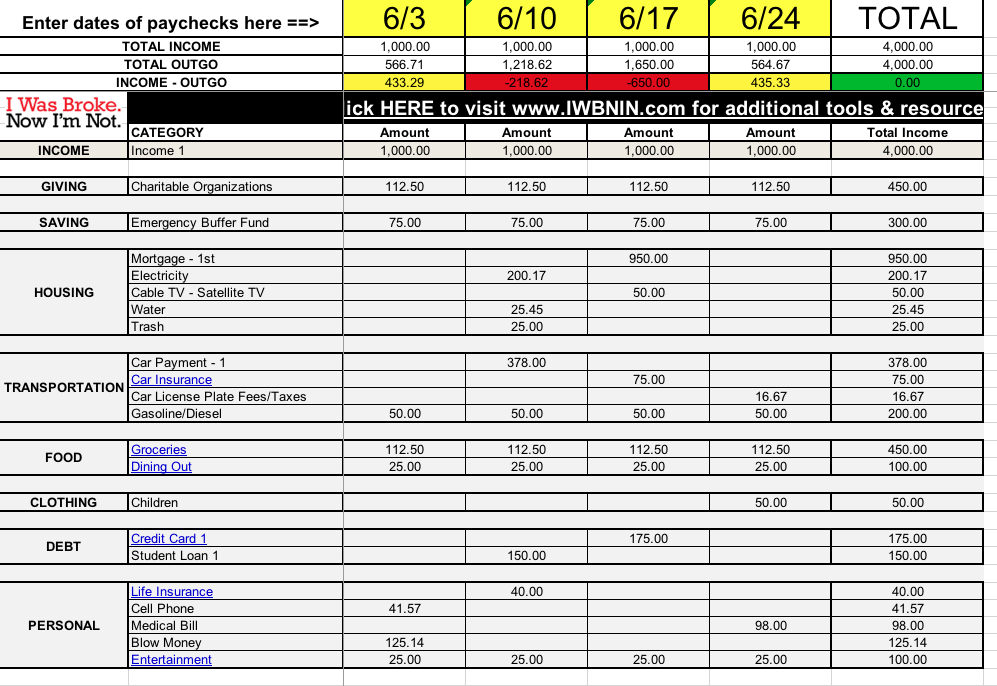

Monthly budget planning tools tv#

Also include any student loan payments you have. for children in K-12 and adults going to college. Education: Tuition, supplies, fees, etc.Transportation: Public transportation like buses, but also car-related expenses, including your monthly loan payment, repairs, insurance, tolls, and fuel.Food: What you spend on food from the grocery store, eating out at restaurants, getting takeout, or meal delivery services.You can also account for other necessary housing-related expenses, like utility bills, homeowners or renters insurance, and maintenance bills. Housing: Your rent or mortgage payment.Income: Your total take-home income, including any money you earn from side hustles, alimony, child support, part-time jobs, etc.

0 kommentar(er)

0 kommentar(er)